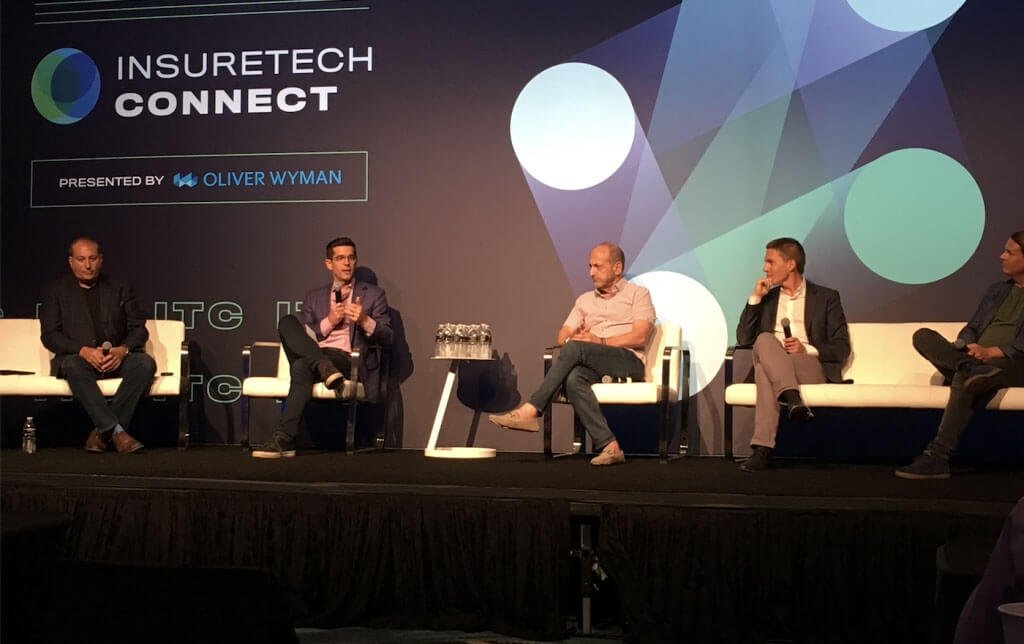

The power of insurtechs was showcased and debated at InsureTech Connect, the world’s largest gathering of insurance leaders and innovators. Snapsheet had a busy couple days as our President, Jamie Yoder weighed in on how working together and creating partnerships can help make a real impact in the industry during the Business Insurance Innovation panel.

“The power of InsurTech is undeniable, but it must be supported by insurers to really progress and advance to its full potential,” said Yoder.

Yoder and leaders from State Auto, Cover Wallet, and Anthemis Group weighed in further on the real impact of insurtechs and identified what’s working – and what’s not – as well as the future of insurtechs ecosystems.

Change the way you change,” Jamie Yoder advised. In order to spur real transformation and innovation you must look at new operating models and capabilities.

If there is one part of the insurance value chain that users of insurance want to see improved, it is claims. On Day 2, our Chief Operating Officer, Andy Cohen, led a discussion to learn how Insurtech companies are delivering an immediate impact across the claims process.

Cohen shared, “From FNOL to payments, there is immediate, tangible impact when you innovate across the claims process.”

Learn more about some of the key insights that were shared:

- AM Best TV’s interview with Jamie Yoder

- Business Insurance, Rapid Progress Relies on Willing Partners

Subscribe for Updates

Top 5 Reasons Why You Should Subscribe

-

#1

Stay up-to-date on industry news and trends

-

#2

Learn about claims management best practices

-

#3

Gain insights into customer behavior and preferences

-

#4

Discover new technologies and innovations

-

#5

Engage with a community of industry professionals

Appraisals

Reduce cycle time and improve appraisal accuracy

Claims

Claims management with our modular, end-to-end solutions

Payments

Deliver payments effortlessly with automated tools and no-code workflows