Significant new customers, employees and partners; Eric Waldinger joins as Chief Revenue Officer to further accelerate growth

CHICAGO, Jan. 27, 2022 /PRNewswire/ -- Snapsheet, the pioneer of virtual appraisals and a leader in claims management software, announced 2021 statistics and sales numbers marking its strongest year yet. Snapsheet enables auto and property carriers, TPAs, MGAs, and mobility to launch claims infrastructure in days rather than years. The year helped showcase the benefits of Snapsheet's no-code self-configuration and automation tools, as Snapsheet's clients could dynamically adapt workflows and customer communications to the demands of the pandemic without incremental IT spending.

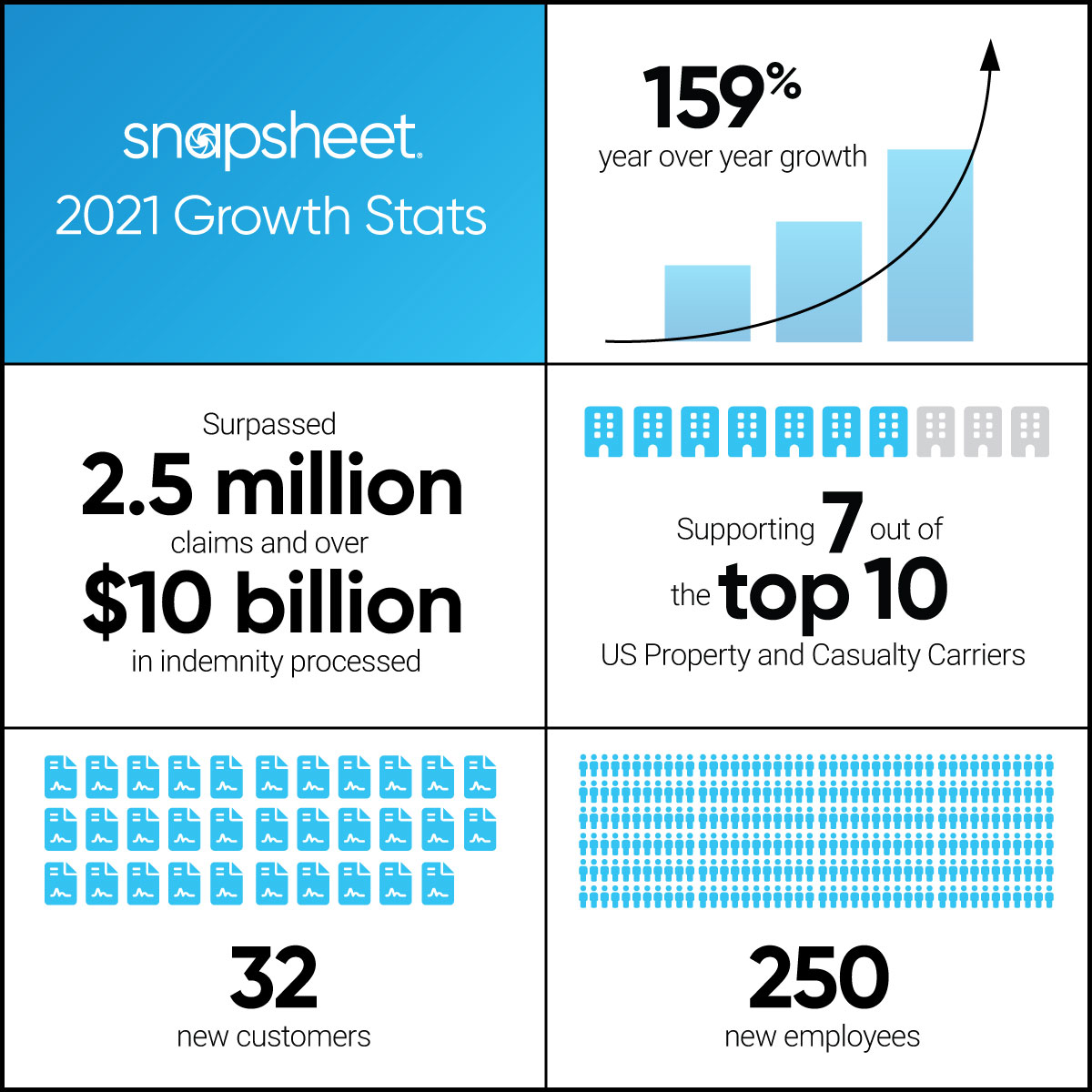

Notable highlights from 2021 include:

- 159% year-over-year growth

- Surpassed 2.5 million claims and over $10 billion in indemnity processed

- 32 new customers

- Supporting 7 out of the top 10 US Property and Casualty Carriers

- Onboarded over 250 new employees

Snapsheet's rapid expansion throughout 2021 reflects the impending shift from managed infrastructure to more adaptable SaaS platforms, which enable the intake of information from various customer channels, including e-mail,

text, or a web and mobile app. The company's ability to automate millions of actions, workflows, processes and tasks supports its continued growth and success. Snapsheet is also ranked number seven in the world's top 100 insurtechs by Sønr, the world's number one startup scouting and innovation platform designed for insurance companies.

"We are proud of our remarkable accomplishments and unprecedented growth in 2021," said Brad Weisberg, CEO and Founder of Snapsheet. "Most insurance organizations rely on large, complex systems, physical interactions with customers and employees on-site five days a week, but the world has changed. Snapsheet built a virtual platform long before the pandemic, and we demonstrated the power of our platform as we helped organizations balance the needs of the new, virtual customer."

In order to accelerate growth and invest further in Go to Market, Snapsheet announced the addition of Eric Waldinger as Chief Revenue Officer. Waldinger joins Snapsheet to focus on business and revenue growth and brings over 20 years of sales, marketing, and strategic leadership with a proven track record of increasing company profitability. Before joining Snapsheet, Eric served as the Chief Marketing Officer at SambaSafety, the market leader of cloud-based risk management solutions for organizations with commercial and non-commercial drivers, and CMO/CRO at FRONTSTEPS, SaaS platform in the property management space.

"I am excited to be joining this incredible and talented team that is leading the charge to create simplified and configurable claims management products," said Waldinger. "The pandemic has emphasized the unprecedented opportunity within the insurance space, and I'm looking forward to bringing solutions to market that don't just help our customers but the end customers – the home and auto owners – as well."

About Snapsheet

Snapsheet is the pioneer in virtual appraisals and a leader in cloud-native claims management software, enabling the most innovative claims organizations to deliver the best customer experiences. With a focus on engagement, digitization, and intelligent automation, Snapsheet provides unmatched software and processes to improve customer experience, drive greater organizational agility, and deliver transformational benefits through its Snapsheet Cloud software suite and Appraisal Services offerings.

Snapsheet leads the industry in claims innovation, including deploying the fastest digital auto insurance claims process in the United States. As a trusted innovation partner, Snapsheet works with over 100 clients, including many of the largest insurance carriers, third-party administrators, MGAs, insurtech, and sharing economy disruptors.

Subscribe for Updates

Top 5 Reasons Why You Should Subscribe

-

#1

Stay up-to-date on industry news and trends

-

#2

Learn about claims management best practices

-

#3

Gain insights into customer behavior and preferences

-

#4

Discover new technologies and innovations

-

#5

Engage with a community of industry professionals

Appraisals

Reduce cycle time and improve appraisal accuracy

Claims

Claims management with our modular, end-to-end solutions

Payments

Deliver payments effortlessly with automated tools and no-code workflows