You'll be in good company.

Trusted by some of the world's leading insurance companies.

Build your claims process in a fraction of the time with intelligent, automated insurance claims management software that fits you.

A digital claims management software designed with customer experience in mind. We think of it as a "Claims Org in a Box", from FNOL to settlement.

“We continuously uncovered and removed friction from the auto collision claims process to unlock a better, faster customer experience.”

Kyle Nakatsuji

CEO and Founder

Clearcover

3M

Claims Processed

5-10

Weeks to get the Platform "Up & Running"

3500

Daily Claims Platform Users

31

Customers on the Platform

Manage auto & property claims from start to finish with simplified workflows and automated processes using Snapsheet insurance software solutions.

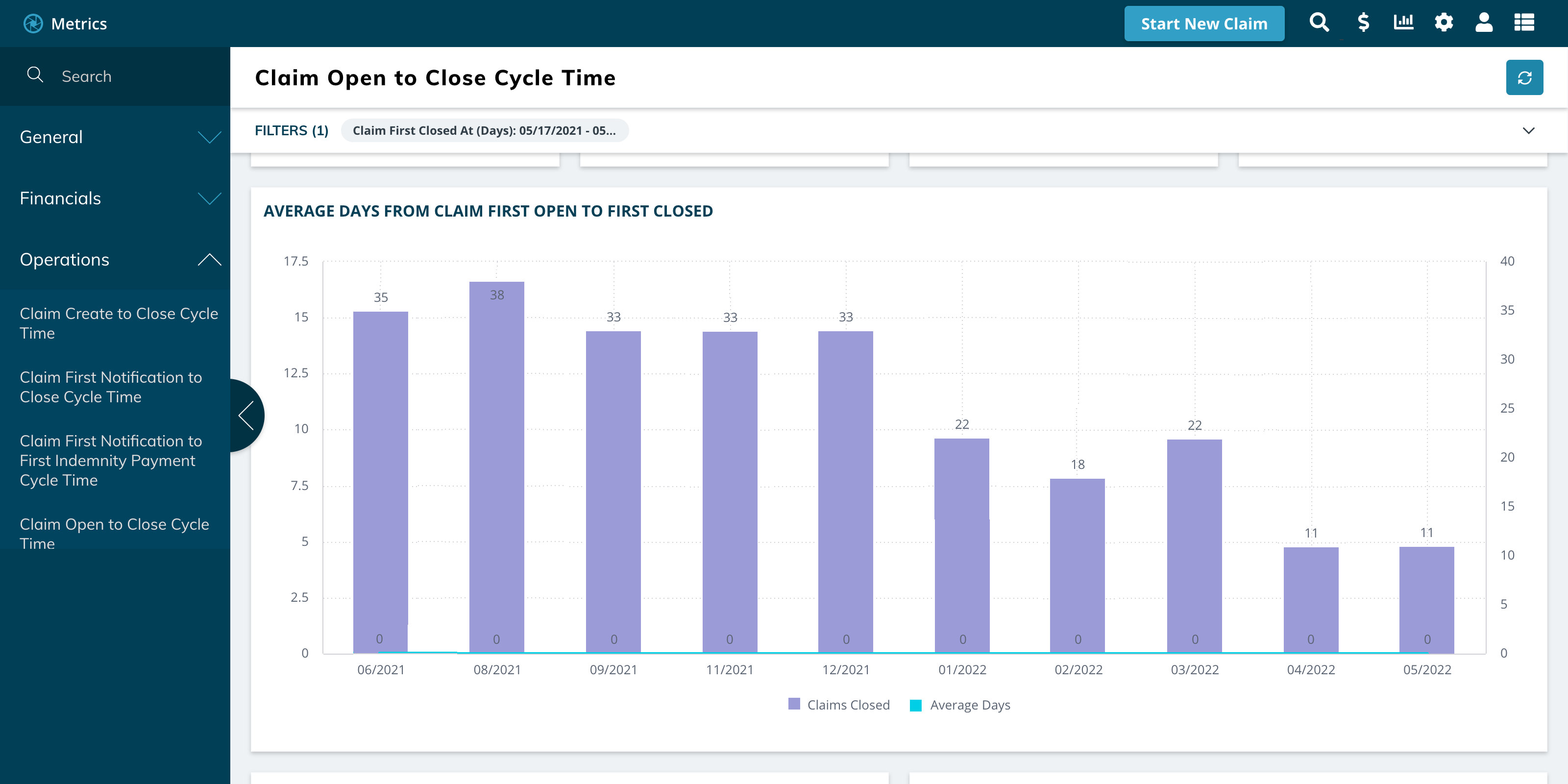

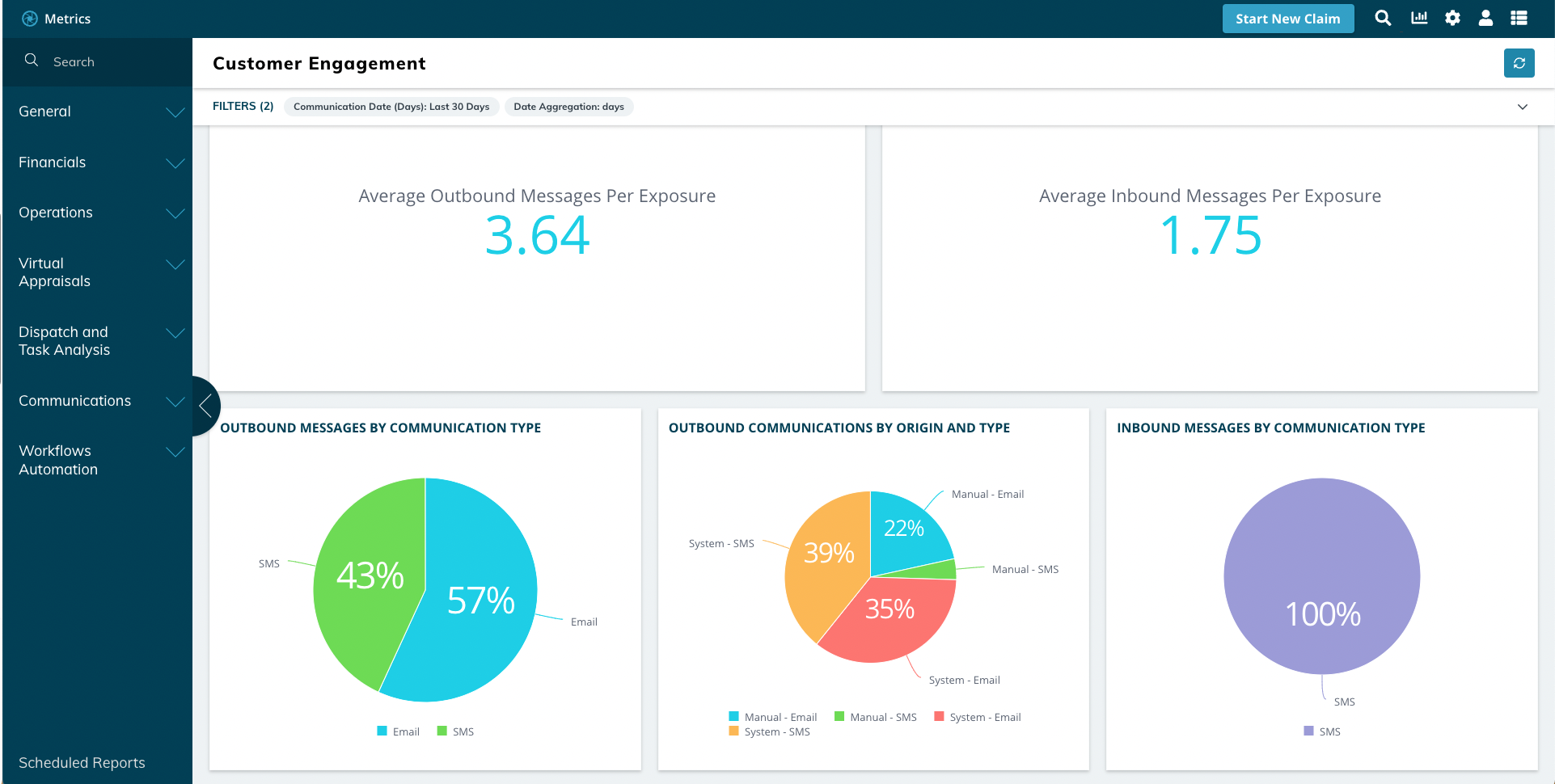

Experience an all-in-one claims management software with built-in metrics & reporting, no code workflows, integrated communication templating through emails & texts.

Get consistent platform updates, as capability improvements are pushed to production every two weeks.

Improve your customer and employee experience with our straightforward, transparent claims management software.

Integrate your ecosystem and partners with the claims management system to reduce cycle time and loss expenses with our robust API layer.

Complex claims are simplified with smart workflow, tailored tools, and powerful integrations with the help of our claims management software.

Claims come in.

Customers report the first notice of loss (FNOL) to insurer.

Our dynamic claims management software reduces customer effort and facilitates proactive communication based on customer preference.

Work is dispatched.

Straight through processing reduces cycle time and manual effort by the adjuster.

Appraisals are delivered.

Our virtual insurance appraisal software eliminates wait time from this critical claims investigation step.

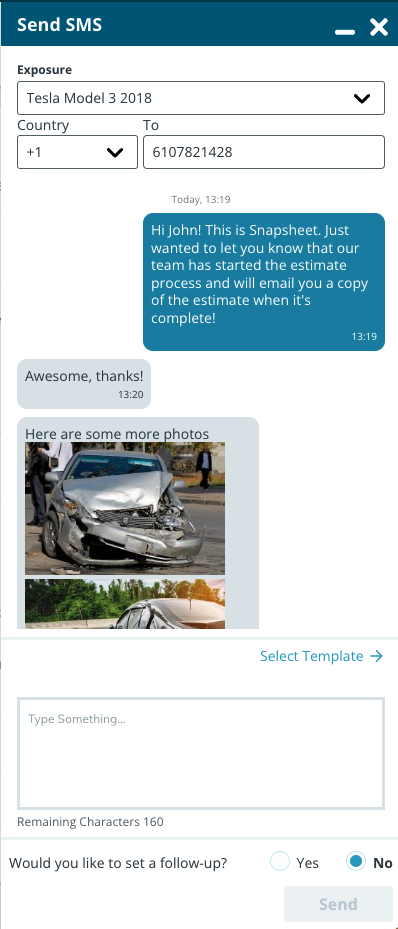

Communicate with customers.

Easily send proactive updates and answer questions with our digital claims software, keeping your customer informed every step of the way.

Settle claims and manage payments.

Our payment platform makes it easy to send payments.

Using our payment platform eliminates wait times and costs from paper checks.

Claims management software your way

Powerful integrations

The right integrations create a cohesive, powerful platform optimizing your results to reduce loss adjustment costs and increase capacity. Scale and grow with strong vendor partners.

Smart automation

Reduce cycle time and waste through smart automation focused on reducing effort and maximizing workflows. Automating manual processes lets employees handle critical, customer-facing tasks.

Reduce complexity

Streamline workflows and processes to reduce complexity, eliminate waste, and triage claims quickly. Route incoming claims to the right adjuster the first time and reduce wasted effort.