You'll be in good company.

Trusted by some of the world's leading insurance companies.

A flexible, fast insurance technology solution designed to improve your customer experience

Snapsheet has a robust streamlined payments platform that makes life easier for you and your customers.

"The implementation with Snapsheet played an integral role in our business continuity plan that we didn’t know we needed until we had it. In the world we’re living in today, digital is key, and Snapsheet was able to seamlessly bring MOE to the digital payments world, which not only benefited our members and vendors, but also our in-house operations."

Michele Wyatt

Chief Operating Officer Mutual of Enumclaw

70%

ACH Adoption vs. Paper Check

10X

Reduction in Transaction Cost for ACH vs. Check

8hrs

Average ACH Payment Submission Cycle

3M

Claims Processed

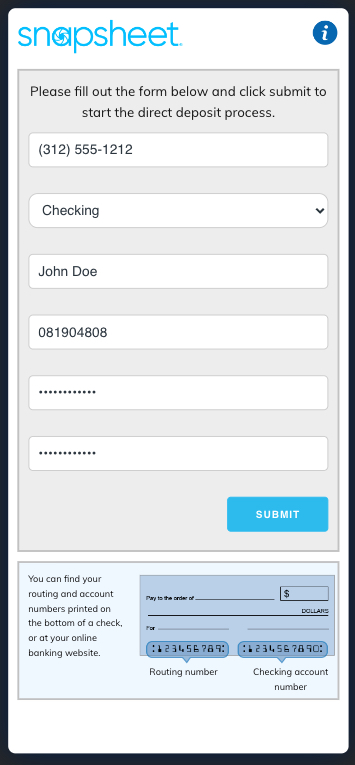

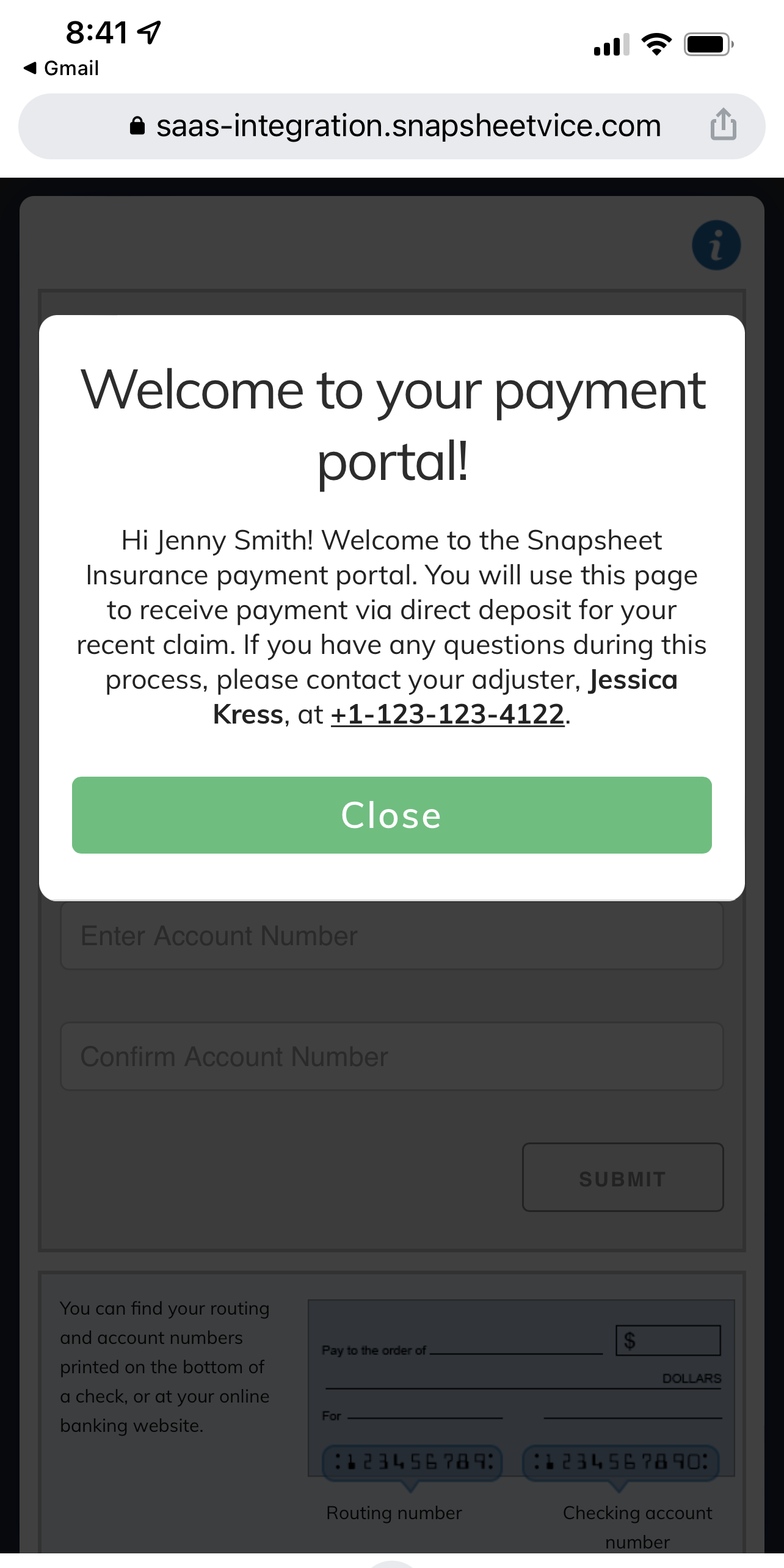

Digital payments are a game-changing solution. No one wants to wait for money, and now your customers don’t have to.

Payments are a pain point in claims.

It’s a common misalignment in expectations in claims. The adjuster issues payment to the customer to close the claim — and from the adjuster’s perspective, the claim is closed. But the customer is still waiting — and waiting — for their check to arrive in the mail.

But what if you could issue payment instantly when you close the claim? Or better yet, what if your system issued payments automatically?

How You Benefit From Our Payments Platform

- Instant payments mean your customer doesn’t wait

- Happier customers rate their insurers higher on surveys

- Customers that have received payments don’t call, email, or leave voicemails for adjusters to manage

- Customers who receive their payment quickly are less likely to complain about their payments

- Employees don’t waste time cutting checks

- Electronic funds transfer is cheaper than paper checks

- Reduce cycle time with instant payments

Deliver digital payments to customers, vendors, and partners through your preferred digital method - leveraging our open API layer.

Enable customers to get sign off from multiple parties & release payment when all signatures are received - with Releases (our multi-party payment solution).

Share payment related documents with customers including explanation of benefits, invoices, etc - automatically shared with the payee.

Eliminate wait time and delight customers with Push to Debit (P2D), ACH, and check payment solutions.

Payments are simple, fast, and customizable with our digital tools.

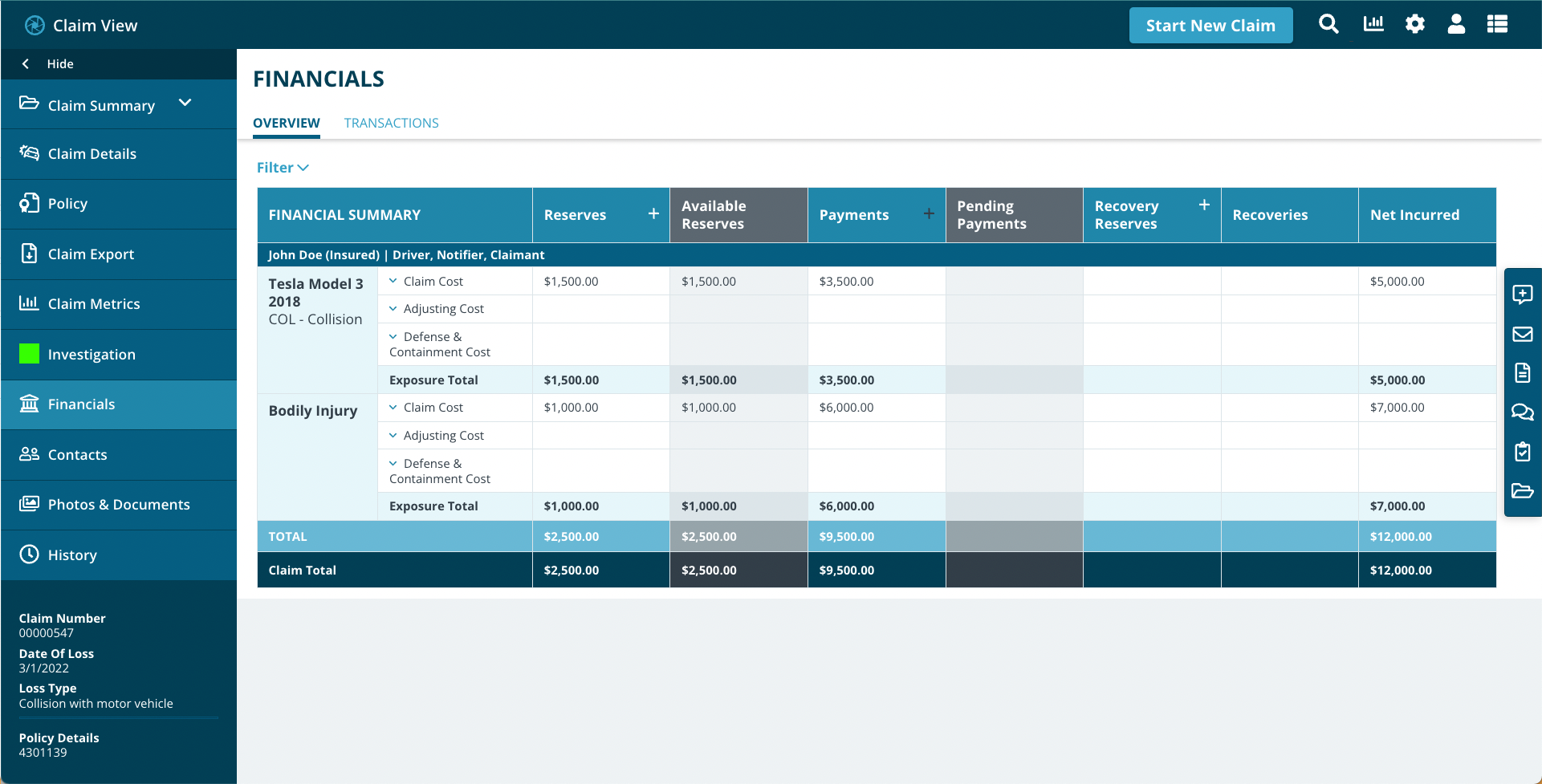

Payment requests are received.

Customers indemnified for covered loss & vendors submit invoices for payment.

Our payments platform is an end-to-end flexible solution for all types of payment requests from first to third party.

Automated workflow begins.

Payment requests are routed through established parameters.

Automated workflows reduce cycle time and eliminate adjuster touchpoints.

Payments are sent.

Instant payments issued at any step in the process.

With instant payments, wait times are eliminated and loss adjustment costs are reduced.

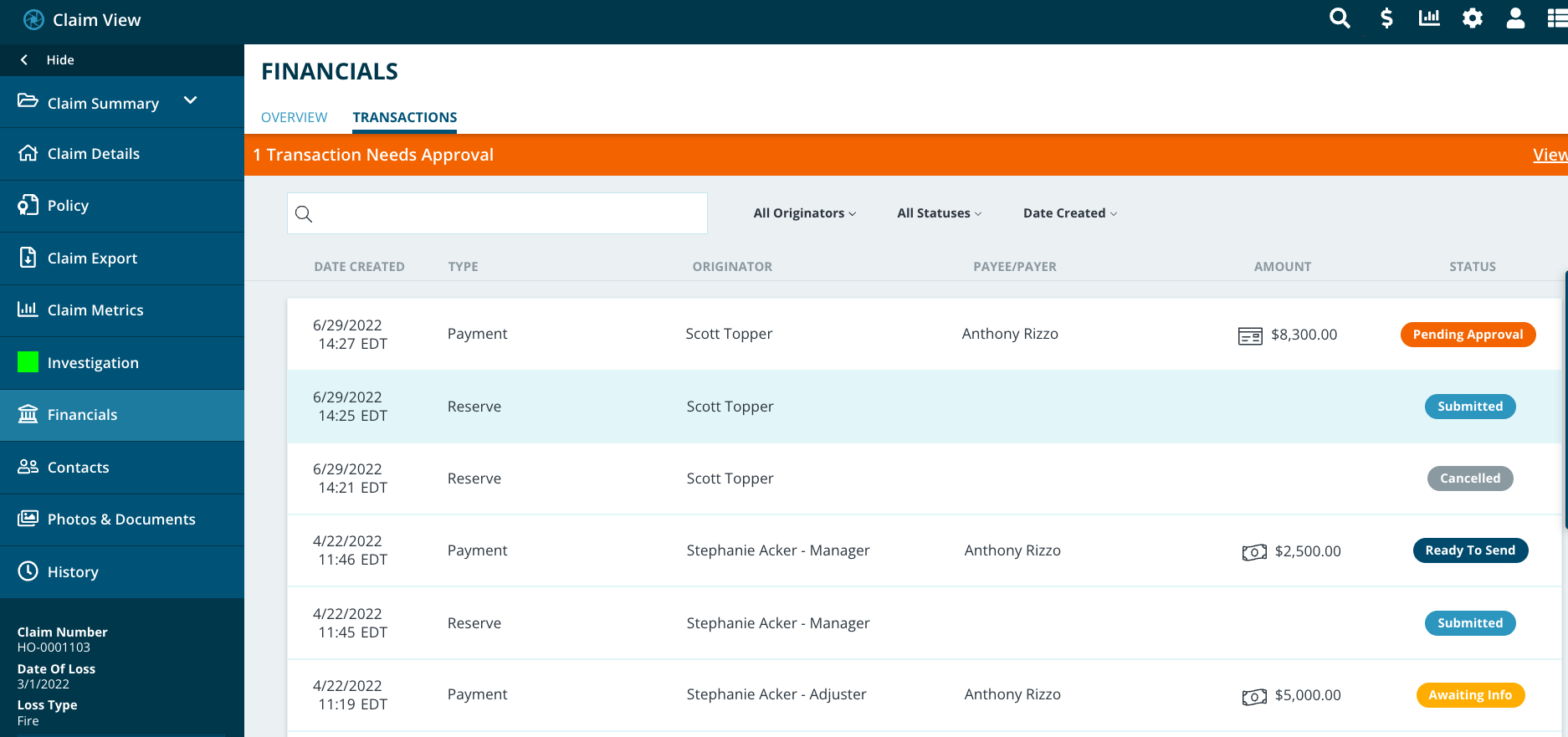

Review high-dollar payments.

Set parameters to review key payment requests.

Triage payments and establish rules to automatically send payment requests in need of manager review.

Delight customers with fast payments.

Automate payments using our robust payment platform.

Eliminate wait time with fast and flexible payments issued automatically to customers and vendors.

Payments your way

Immediate payment transfers

When customers need money right away after a loss to get back to their life, issuing an electronic payment quickly and seamlessly solves their problem. Whether after a catastrophic loss or a simple fender bender, immediate payment transfers gets money to customers quickly.

Automate workflows

Set parameters for automated payments to reduce inefficiencies and waste. Decide when payments should be issued automatically — and when an adjuster should review the payment request first.

Reduce cycle time

From the customer’s perspective, the claim isn’t resolved until they receive payment for their damages. And sending a check through snail mail delays this even more. Our payment platform eliminates the wait time — reducing cycle time and delighting customers.