You'll be in good company.

Trusted by some of the world's leading insurance companies.

A simple digital insurance estimating software solution

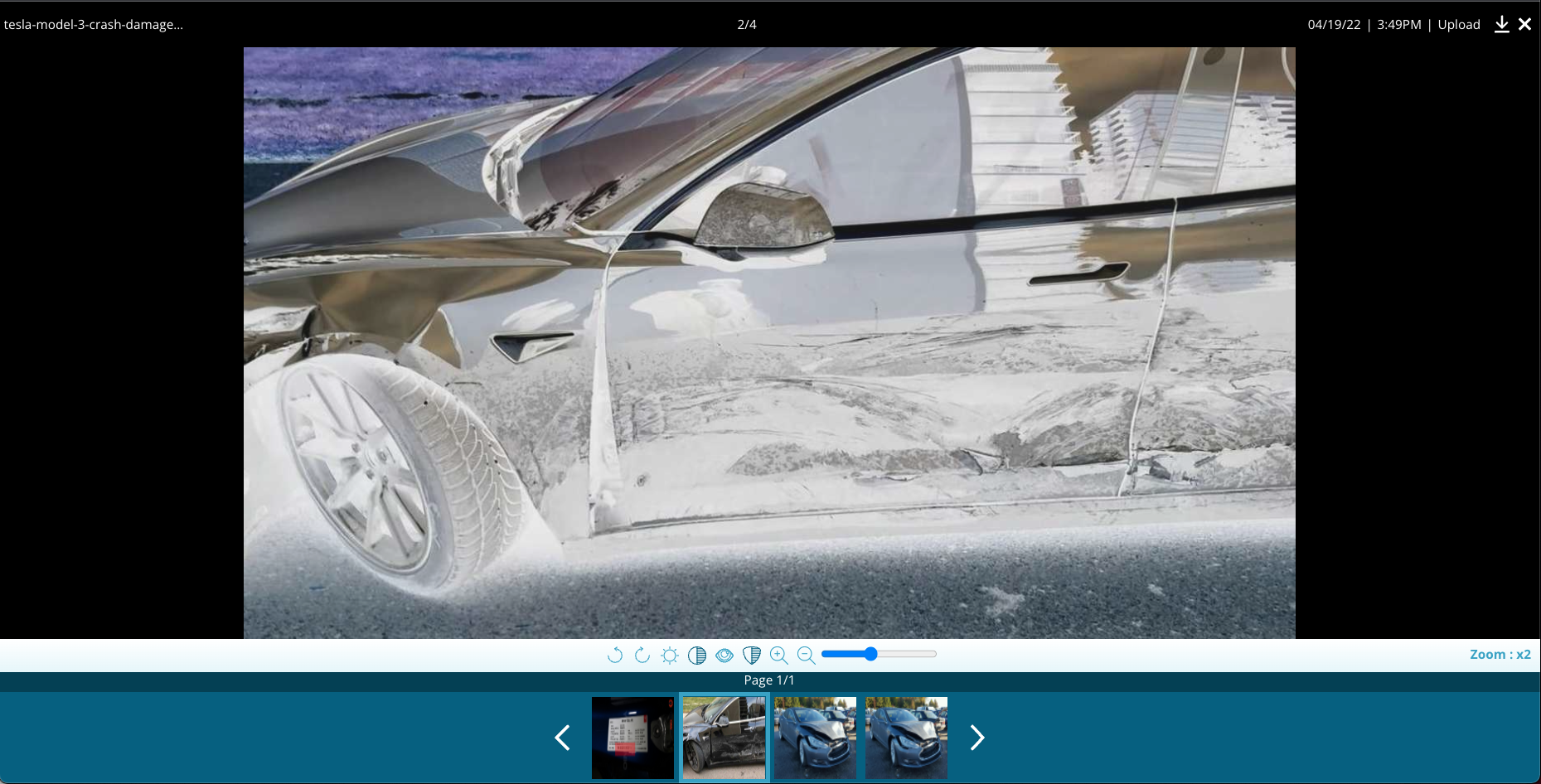

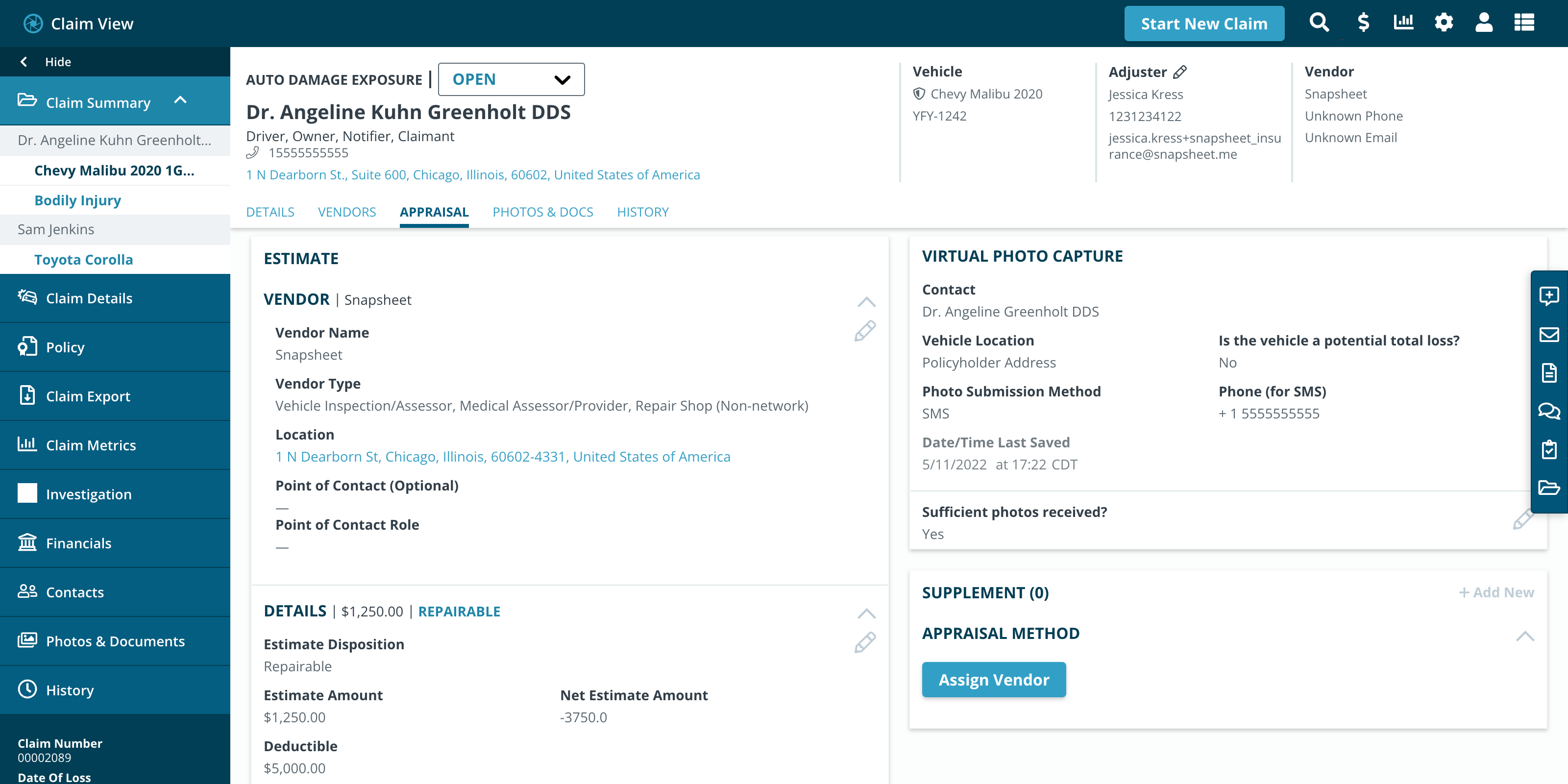

With our virtual appraisals software, customers can easily send vehicle damage photos, communicate with our team, and receive their estimate in minutes, regardless of vehicle location, type, and severity.

“Snapsheet has been a long-term appraisal partner and has always demonstrated innovation, accuracy, and speed. Snapsheet has been instrumental in reducing cycle time, improving expenses and driving a best-in-class customer experience.

Their digital appraisal solution allows carriers to manage workflow and find new efficiencies. I highly value my partnership with Snapsheet.”

Kenneth Rosen

Former Chief Claims Officer

USAA & Allstate

300+

Full-Time Appraisers

#1

In Specialty Vehicles

20%

Improved Appraisal Accuracy

>50%

Avg. Savings Per Claim vs. Traditional IA

Enable a “touchless” claims experience with Intelligent Photo Acquisition, our industry-leading capability that recognizes photos through web app, SMS, and email to determine the appropriate photo overlays based on make/model of the vehicle.

All kinds of losses can be reviewed, from simple fender benders and scrapes to total losses and CAT damage.

Available in all 50 states.

Virtual appraisals happen wherever the vehicle is located — body shops, homes, tow yards, storage facilities, or side of the road.

Fully digital, innovative platform designed with the customer in mind.

The right work to the right people at the right time - a dedicated team that complements your appraisal staff, while helping maintain efficiency.

Insurance appraisal technology that makes estimating & repairs easy, fast, and accurate.

Receive FNOL

• eFNOL

• Display of related files

• Estimating location mapping

• Shop locator

• Dynamic, guided interaction

• Ingest any data type

Obtain Photos & Documentation

• Stages/actions to specialize resources

• Proactive user prompts for additional photos

• Auto-text follow up

• Automated, omnichannel communications

Dispatch Work

• Configurable role-based rules administration

• Inventory management

• Capacity visualization

• Rules and skill-based assignment routing

• Automatic reassignment

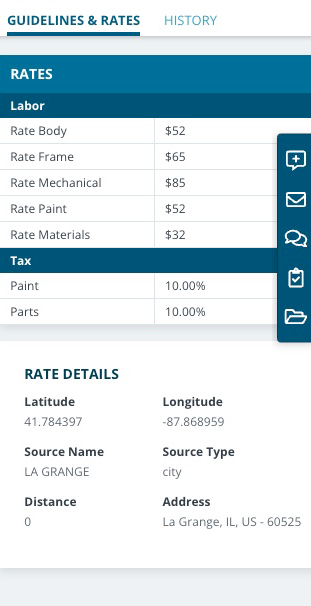

Appraise Damage

• Estimating claim view

• State-specific guidelines

• Historical labor rates

• Total loss calculators

• Real-time metrics around performance and audit

Manage the Repair

• Supplement portal

• Shop application

• Historical negotiated amounts w/ concessions

• On-demand Operational and historical metrics

Insurance appraisals your way

Supplement appraisal staff

Some of our customers set a workflow using our platform to supplement appraisal volume. If more claims are received than their appraisers can review, some of the volume shifts automatically to Snapsheet. Other customers set a timeframe — if their in-house adjusters can’t review within a certain number of hours or days, the claim goes to Snapsheet’s appraisers for a virtual inspection.

Reduce IA dependency

Lessen your IA use with Snapsheet’s Virtual Appraisals. In those remote locations or when you have too much volume, instead of relying on IAs you can manage your volume in-house with Snapsheet. Send a percentage of your inspections through the virtual appraisal process instead of to IAs and keep control of the inspection and cost.

Triage total losses and repairables

Snapsheet’s platform can help you triage total losses and repairable vehicles, letting you send the totals to salvage and the repairable vehicles to an in-house inspection process. You have total control to design and manage your volume while routing vehicles to the most appropriate repair process.