Reflecting on 2023, Snapsheet, the leading global provider of insurance claims management solutions, stands at the threshold of a transformative year. This review on the past serves not just as a celebration of Snapsheet's exceptional milestones, but as an affirmation of its unwavering commitment to delivering unparalleled value and steering a positive course for profitable growth.

In an industry where opportunities for progress are extensive, Snapsheet's achievement of profitability stands as a validation of its resilience and the loyal support from clients, partners, and staff. This accomplishment sets a strong foundation to propel the organization into a future characterized by innovation, stability, and profitability.

Key Achievements and Growth

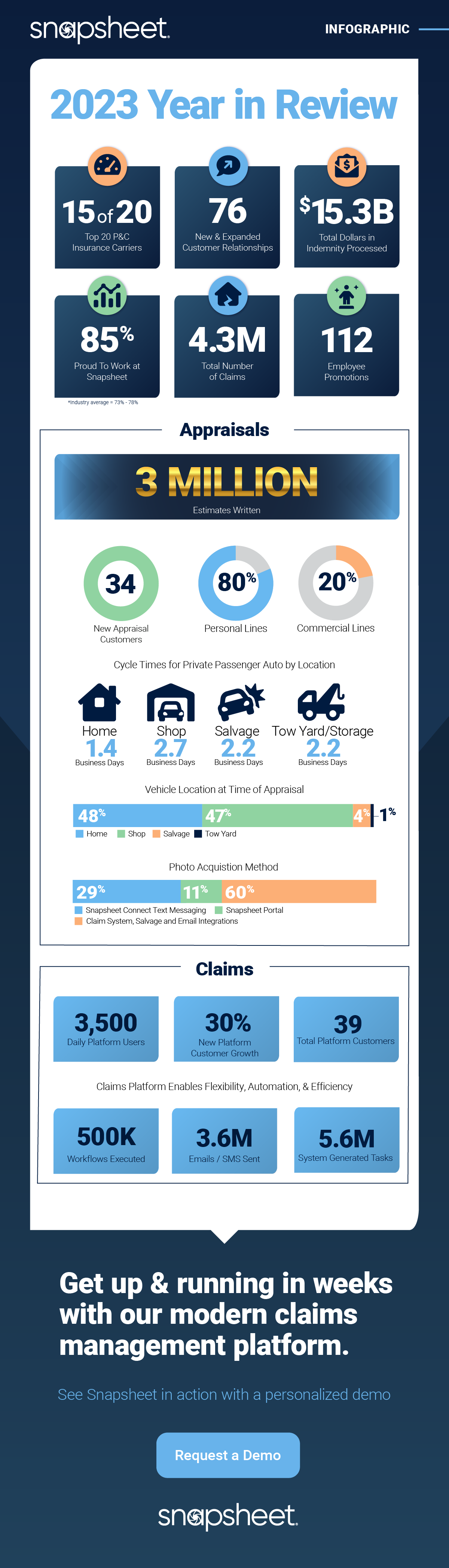

In 2023, Snapsheet solidified its position by serving 15 of the top 20 P&C insurers in the US, a clear sign of its growing influence. Building on this, Snapsheet fostered 76 new and expanded customer relationships, further extending its reach and reputation. Celebrating an impressive 13% year-over-year growth, Snapsheet swiftly managed over 4.3 million claims, processing $15.3 billion in indemnity, showcasing its expertise across virtual appraisal services and claims management.

Industry Recognition

- State Farm Ventures: Snapsheet secured strategic investment from State Farm Ventures®, fueling digital innovation in claims management technology.

- Financial Expertise: Sue Sell, CFO, was awarded the 2023 Mid-Size Private Company CFO of the Year® by Financial Executives International (FEI) Chicago.

- Global Recognitions: Snapsheet retained its position in Sønr’s Top 100 Insurtechs and was recognized by FinTech Global among the world's top 100 innovative InsurTech companies for contributions to the industry.

- Fintech 250 Honor: CB Insights honored Snapsheet among the top 250 promising private fintech companies for the fifth consecutive year.

- Remote Work Culture: Built-In recognized Snapsheet for outstanding work culture, ranking among the best places in Chicago and for remote companies.

Strategic Outlook

Looking ahead to 2024, Snapsheet is poised for even greater achievements amid an evolving insurance landscape. In a year marked by high inflation and challenges in rate and capacity for insurers, Snapsheet remains focused on innovative claims solutions and initiatives that save time and money while enhancing customer experiences. Their strategic vision takes shape with these guided principles:

- Continuous Innovation: Snapsheet emphasizes constant internal innovation, fostering partnerships to streamline and automate claims processes.

- Digital Insurance Solutions: Positioned amid the rise of embedded insurance and a shift towards personalized experiences, Snapsheet focuses on delivering technology-forward solutions.

- Operationalizing AI: Anticipating a transformative shift in technology deployment in 2024, Snapsheet prepares to operationalize AI, making it a primary differentiator in the industry.

As Snapsheet wraps up an extraordinary year, CEO Brad Weisberg shares optimism, stating, "The future is strong at Snapsheet. Building on the momentum of 2023, Snapsheet drives forward. In 2024, the focus remains on simplifying claims with speed, efficiency, and accuracy, delivering a differentiated experience for valued customers and partners."

In the ever-changing insurance landscape, Snapsheet stands at the forefront, leading innovative digital insurance solutions and paving the way for excellence. Snapsheet eagerly anticipates the opportunities and challenges that 2024 will bring, confident in its ability to drive effective partnerships and deliver desired claims outcomes.

About Snapsheet

Snapsheet, a leader in claims management technology, ignited the virtual appraisals revolution and is a trailblazer in streamlining processes for auto, property, and commercial lines. Collaborating with 140+ partners, including leading insurance carriers, TPAs, MGAs, and insurtechs, Snapsheet ensures excellence in claims, appraisals, and payments through advanced technology.

Subscribe for Updates

Top 5 Reasons Why You Should Subscribe

-

#1

Stay up-to-date on industry news and trends

-

#2

Learn about claims management best practices

-

#3

Gain insights into customer behavior and preferences

-

#4

Discover new technologies and innovations

-

#5

Engage with a community of industry professionals

Appraisals

Reduce cycle time and improve appraisal accuracy

Claims

Claims management with our modular, end-to-end solutions

Payments

Deliver payments effortlessly with automated tools and no-code workflows