Snapsheet is the leading global Insurtech provider of virtual appraisals and claims management software. 2022 resulted in continued strategic growth and new opportunities for the company.

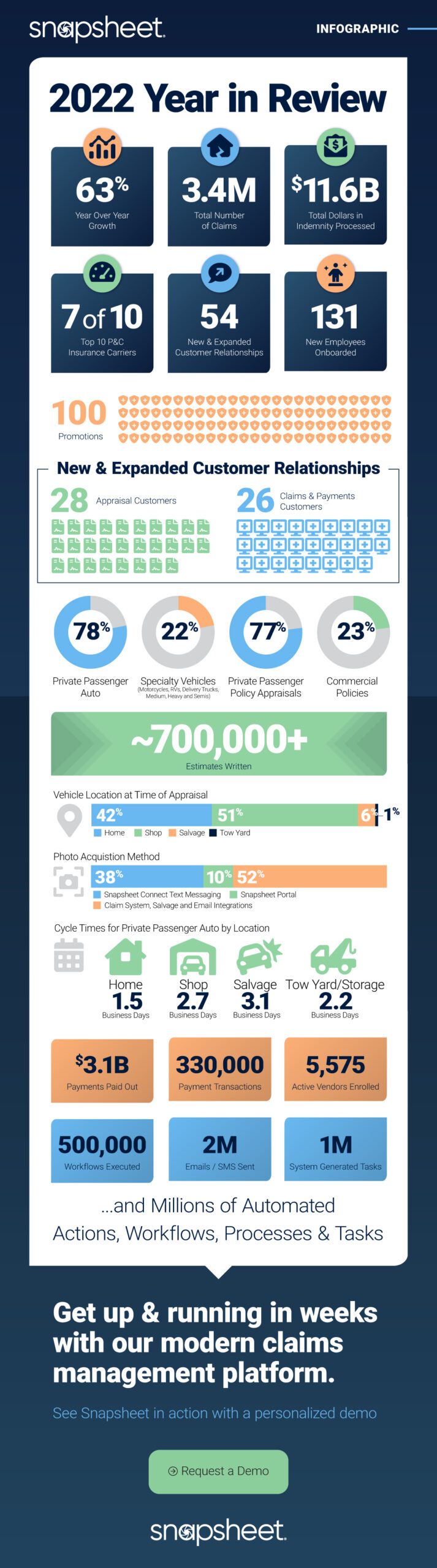

2022 Key Results

- 63% year-over-year growth

- 54 new & expanded customer relationships

- 28 appraisals customers

- 26 claims & payment customers

- 700,000+ total appraisals estimates written

- 150,000+ specialty vehicle estimates written (Motorcycle, RV, Medium & Heavy Duty Trucks, and Ag Equipment)

- $3.1 billion in claims payments

- 131 new Snapsheet employees

- 100 Snapsters promoted

- Millions of automated tasks, workflows, & processes managed through Snapsheet’s platform

“Snapsheet delivered another fantastic year of operational performance with growth north of 60% - two years in a row,” Snapsheet Founder and CEO Brad Weisberg said. “We’re proud of the 50+ new & expanded customers we supported in 2022 and are thrilled to pass more than 3 million claims appraisals written.”

2022 Notable Highlights

Together our team accomplished strategic milestones including:

- Snapsheet once again named to Sønr’s Top 100 Insurtechs, compilation of leading insurtechs from around the world who are reshaping insurance.

- CB Insights recognized Snapsheet in its fifth Fintech 250, an annual global list of the 250 most promising private fintech companies. Snapsheet was 1 of only 25 insurtechs honored with this distinction.

- Built-In recognized Snapsheet as one of the top fully remote companies, having proudly created a highly engaged & productive remote-friendly atmosphere.

- Financial Executives International (FEI) Chicago names Susan Sell, a finalist for their Small Private Company, 2022 CFO of the Year Award.

- Honored to be named a 2022 CityLIGHTS finalist at 1871 Chicago’s Momentum Awards, recognizing growth stage companies who are “serious competitors in the marketplace.”

Snapsheet proudly works with 7 of the Top 10 P&C insurers in the US, along with top MGAs, Insurtechs, TPAs, and self-insureds - and the list of valued ecosystem partners continues to grow.

2023 Strategic Outlook

Inflation remains high and insurers are expected to face challenges with rate and capacity in 2023. These continued challenges suggest the industry prioritize solutions saving time and money, while improving the customer experience.

Incumbent carriers have a tremendous opportunity to deliver customer value in 2023 by integrating partnerships with technology providers to streamline and automate claims processes. It’s time for solution providers to collaborate, design, and deliver a suite of solutions with incumbents. Snapsheet’s ongoing innovation, development, and powerful APIs allow us to drive effective partnerships and desired outcomes.

Snapsheet is positioned to provide tech-forward solutions to improve the customer and adjuster experience. Customers demand a seamless digital claims experience, and Snapsheet delivers with our claims management software, virtual appraisals solutions, and payment distribution; automating millions of interactions, processes, and workflows.

“The future is strong at Snapsheet. We’re building on the momentum from 2022 and will keep driving forward. 2023 is positioned to be our best year yet, as we offer customers and partners a differentiated claims experience focused around improved efficiencies, claims outcomes, and customer experiences”, said Weisberg.

About Snapsheet

Snapsheet started the virtual appraisals revolution and is a leader in claims management software, enabling claims organizations to deliver seamless customer experiences. Snapsheet was built on claims innovation, having deployed the fastest digital auto insurance claims process in the United States.

As a trusted partner, Snapsheet works with more than 140 customers, including many of the largest insurance carriers, TPAs, MGAs, and insurtechs. We simplify claims, streamline appraisals, and scale payments with insurance technology for the modern world.

Subscribe for Updates

Top 5 Reasons Why You Should Subscribe

-

#1

Stay up-to-date on industry news and trends

-

#2

Learn about claims management best practices

-

#3

Gain insights into customer behavior and preferences

-

#4

Discover new technologies and innovations

-

#5

Engage with a community of industry professionals

Appraisals

Reduce cycle time and improve appraisal accuracy

Claims

Claims management with our modular, end-to-end solutions

Payments

Deliver payments effortlessly with automated tools and no-code workflows