Insurance technology for the virtual world.

Simplify Claims.

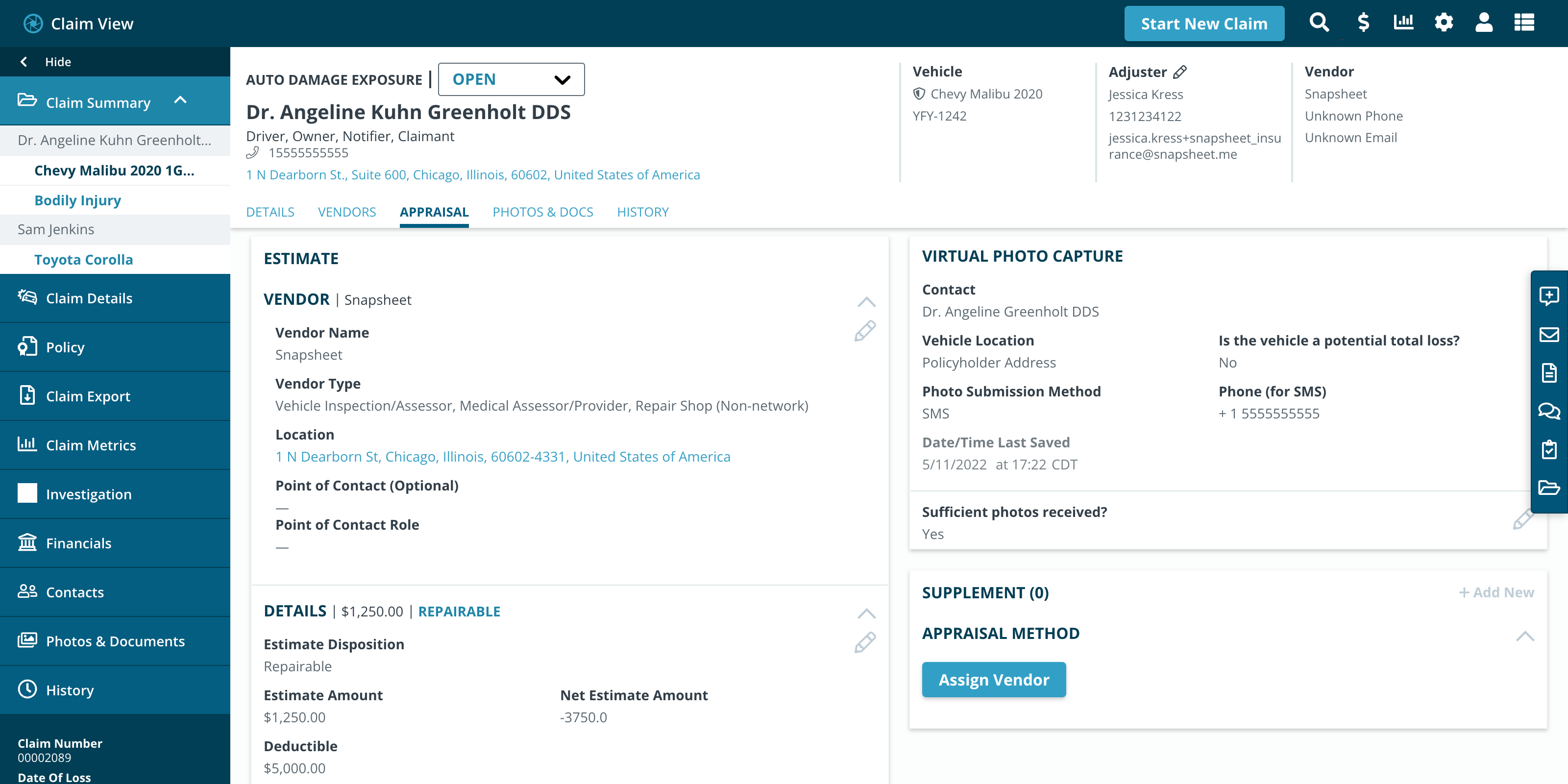

Streamline Appraisals.

Scale Payments.

$7B

Appraisals completed

+90%

Virtual appraisal adoption

2M

Claims processed

+125

Global clients

My organization is a P&C Carrier, that handles 1000-2500 monthly claims, and is looking to simplify our claims process.

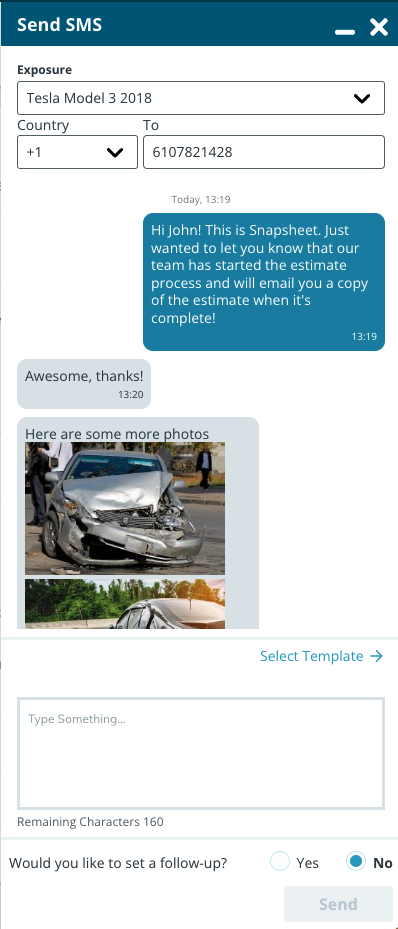

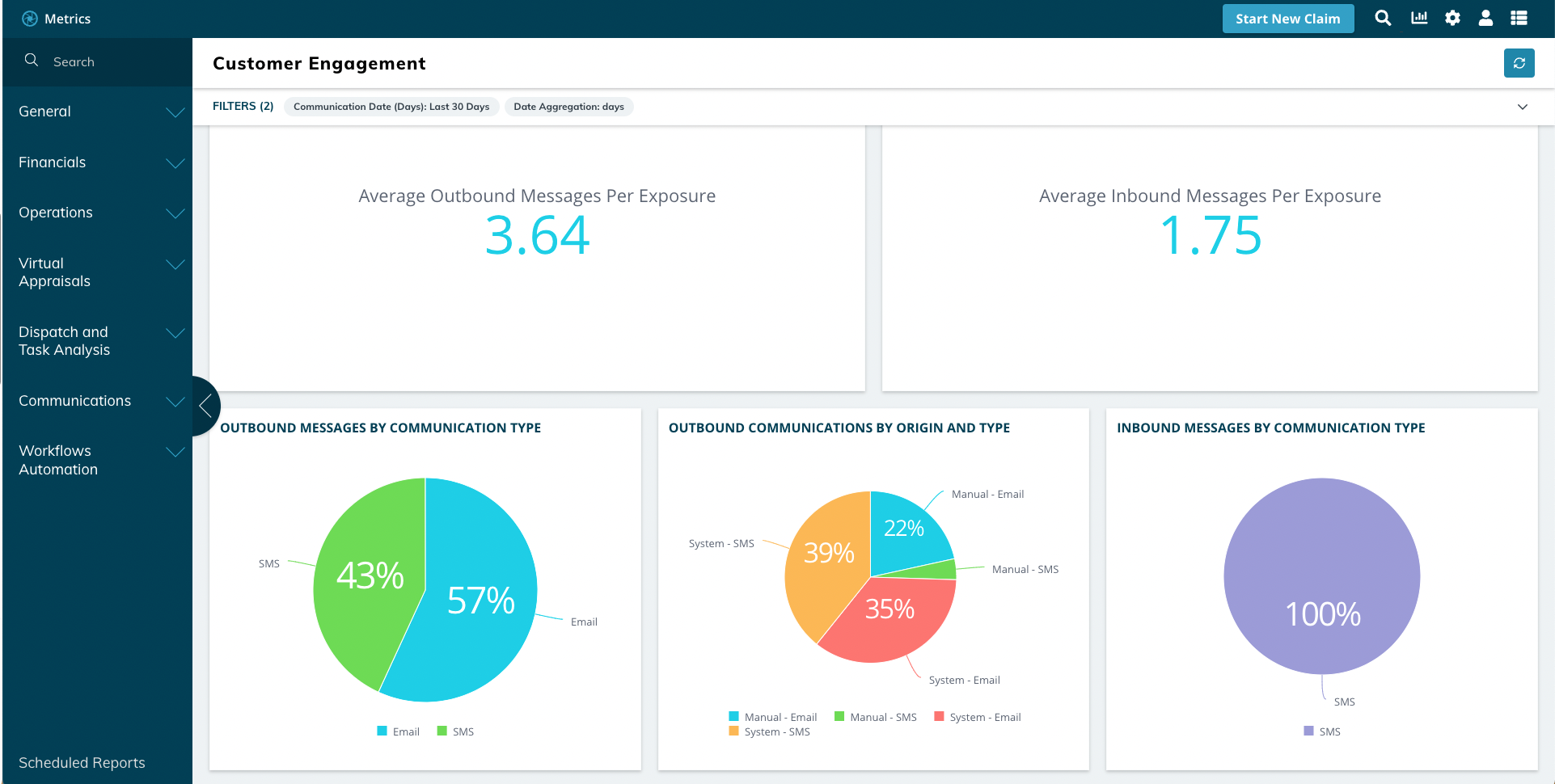

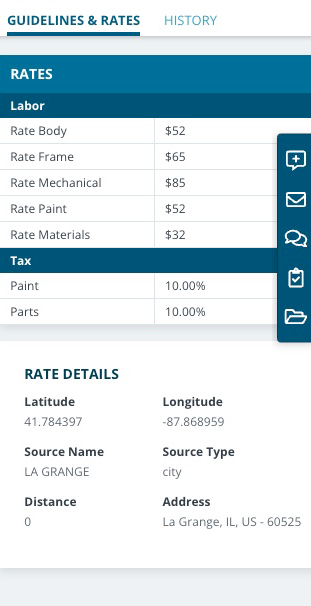

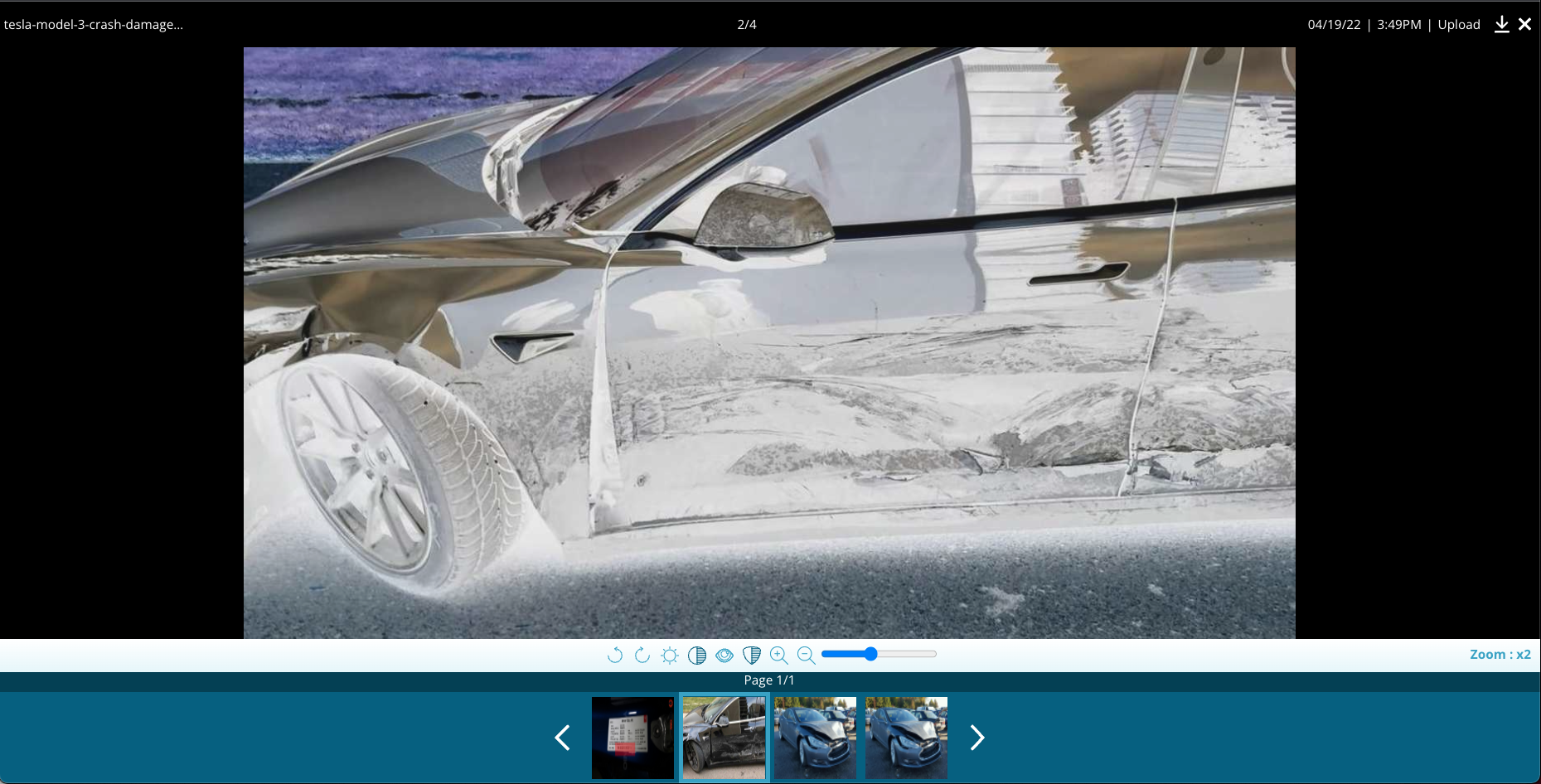

Deliver superior customer experiences and reduce loss expenses with our virtual appraisals.

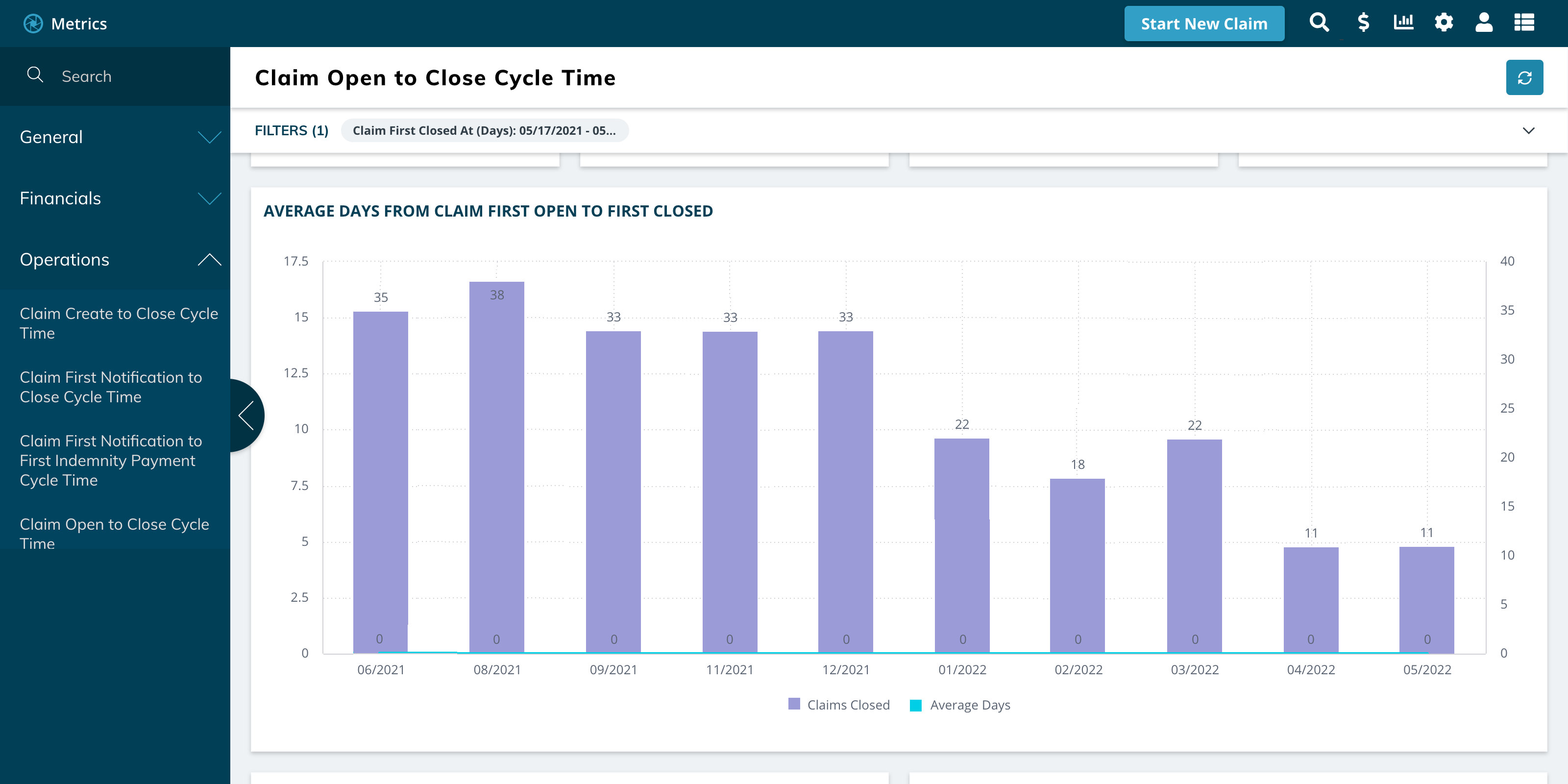

Automate communications, reduce cycle time, and improve adjuster efficiency using our cloud-native claims management platform.

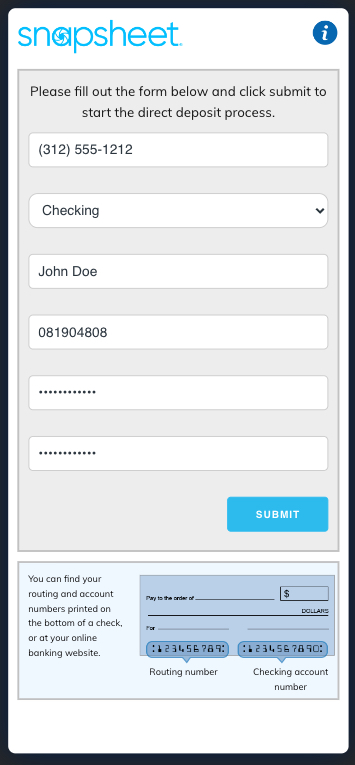

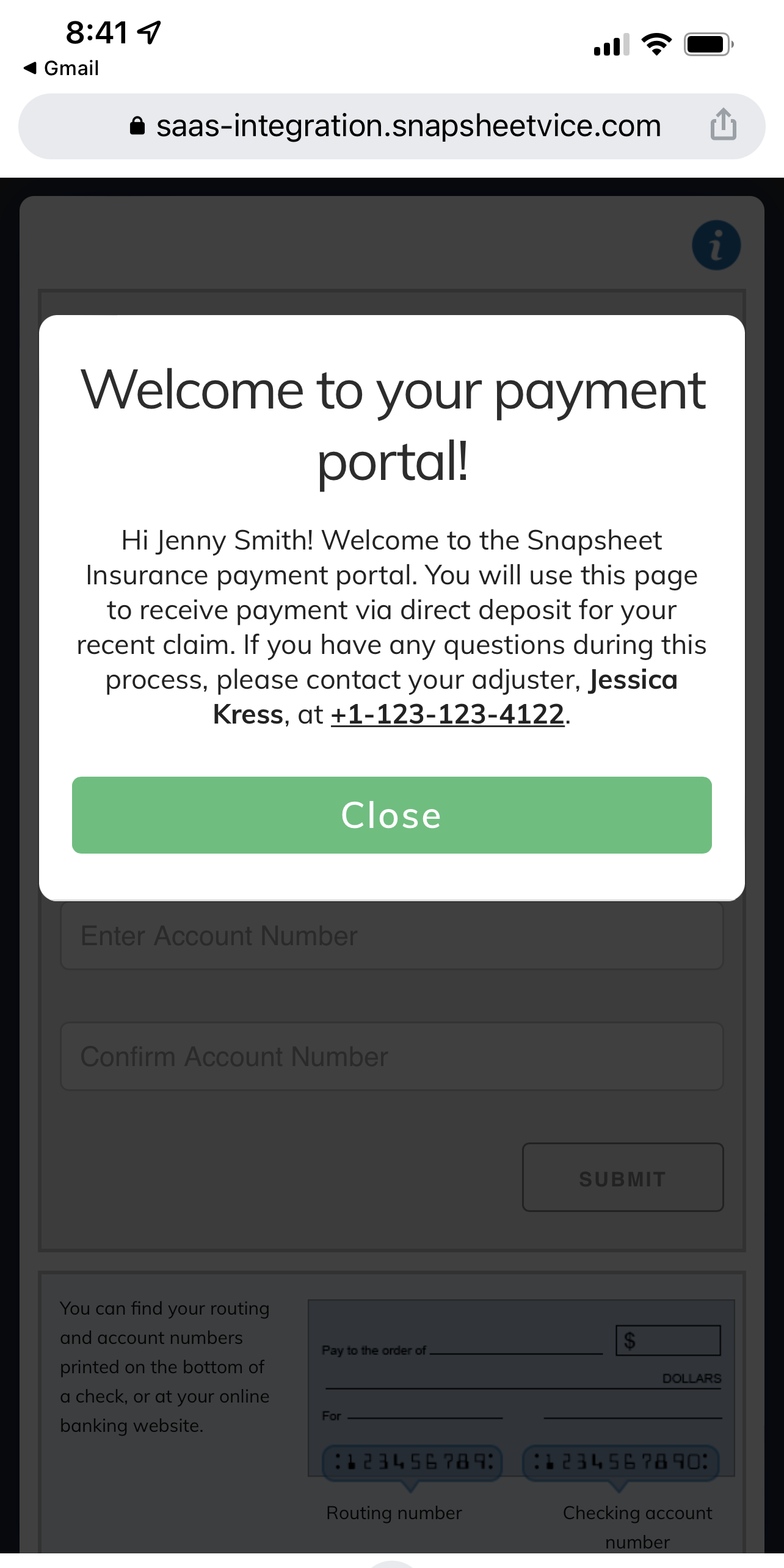

Accelerate and simplify payments with our easy, end-to-end digital payments solution.

We empower our clients to write their own success stories using our digital solutions and cloud-native technology.

![]()

Clearcover reduced claims cycle times and issued payments within minutes.

Snapsheet's digital expertise empowered Clearcover to stand up its system in only 3 months.

Innovative Claims Experiences Drive Customers Back.

Getaround looked to Snapsheet for knowledge and expertise on how to handle virtual estimating and appraisals

5X Faster, More Efficient Claim Payments

Digitization of claim and vendor payments leads to business resilience

The future of the auto physical damage claim landscape.

Sedgwick will be adding this service to interested new and existing clients.

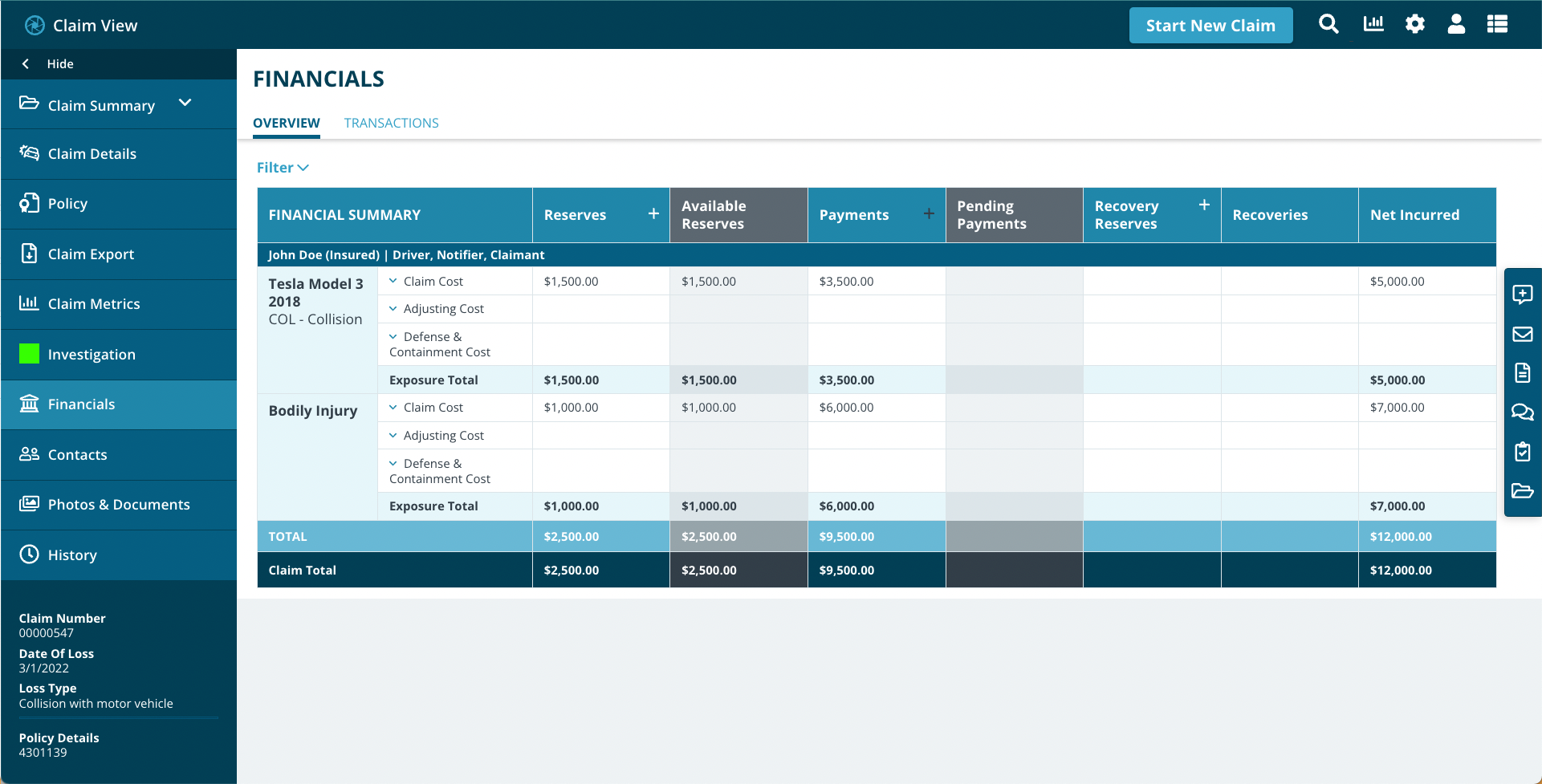

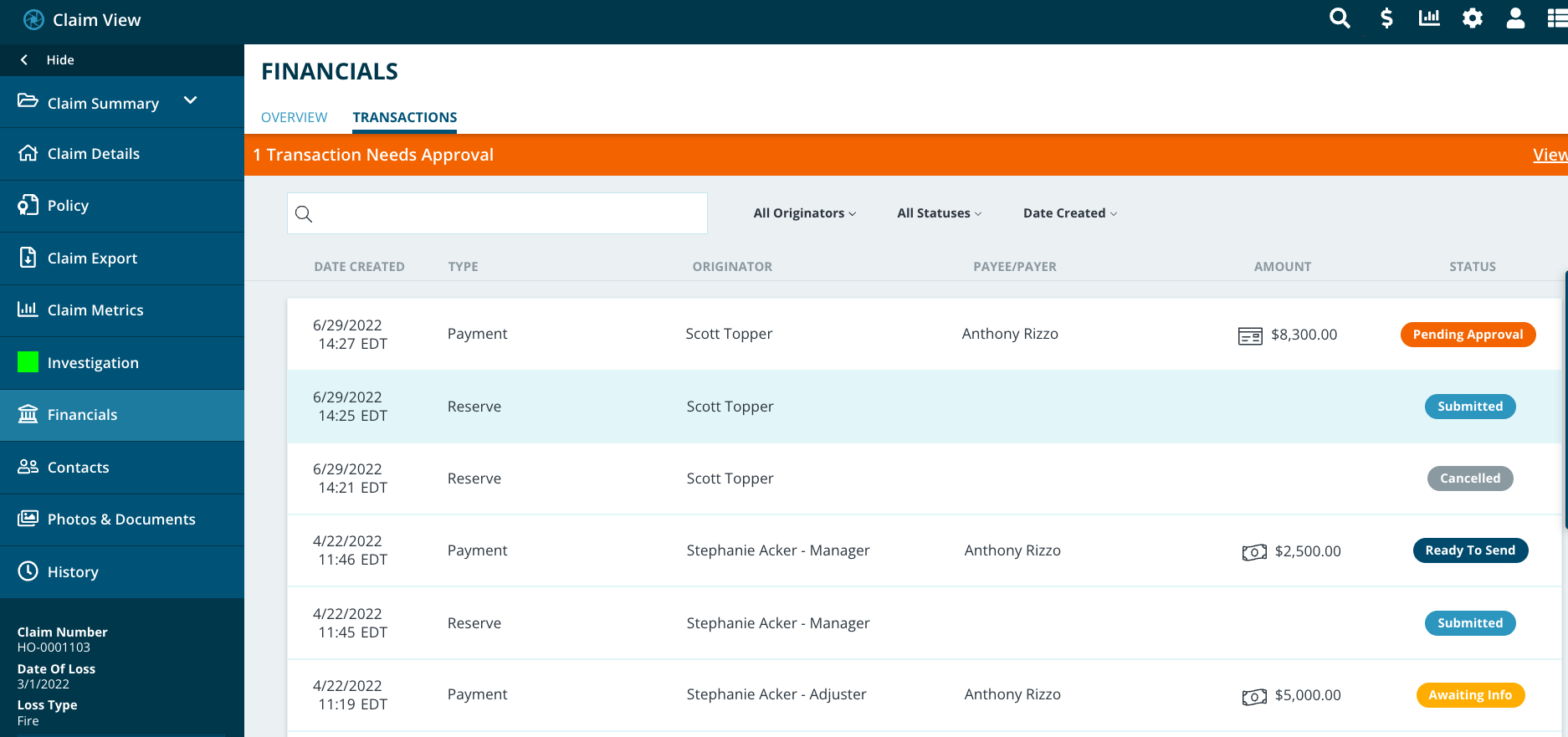

Powerful Insurance Claims Payment Solutions.

Eventually replacing a legacy payment system becomes more challenging than embracing a new platform.

The value just adds up when your people can focus on the important stuff — taking care of your customers.

I'm ready to

Work more efficiently

through smart process automationAutomate manual processes

and reduce human errorsSave time and money

by digitizing the right processesEmpower my customers

with virtual appraisal software to save them time and effortReduce cycle time

and increase customer satisfaction with smart claims managementSnapsheet News

The Blueprint to Successful Change Management for Insurers

An ever-evolving world means insurers must prioritize managing transformations effectively to navigate and succeed.Change management is a significant component of any successful transformation project. It means guiding organizational change to […]

Talem AI and Snapsheet Announce Strategic Partnership to Transform Auto Insurance Claims Management

[Boston, April 2, 2024] – Talem AI, a leading innovator in predictive analytics for auto injury claims, and Snapsheet, an industry-leader in claims management technology, are pleased to announce a […]

Accelerating Success: Snapsheet’s 2023 Results and Strategic Vision for Innovative Claims Management

Reflecting on 2023, Snapsheet, the leading global provider of insurance claims management solutions, stands at the threshold of a transformative year. This review on the past serves not just as […]

Efficiency Unleashed: Steadily Insurance Chooses Snapsheet for Superior Claims Experience

CHICAGO, IL February 7th, 2024 – Steadily Insurance Agency, Inc., a leading player in property insurance for landlords, has selected Snapsheet, a leader in claims management technology, to enhance and […]

Looking Beyond Legacy Models: The Evolution of Claims through Collaboration and Innovation

How the best claims partnerships leverage technology to benefit customersIt’s no surprise that impactful partnerships are paving the way for success in the insurance industry. In fact, it has always […]

AI and Insurance: Building a Future of Enhanced Efficiency

How Insurance Industry Experts are Leveraging AI for Smarter Claims ManagementThe future of the insurance industry is in the approach of building and expanding a strong foundation for operations, as […]